+254746204266

info@seamlineinnovations.com

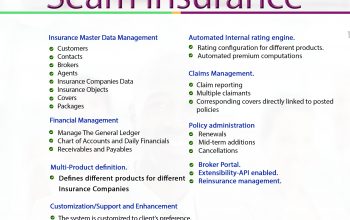

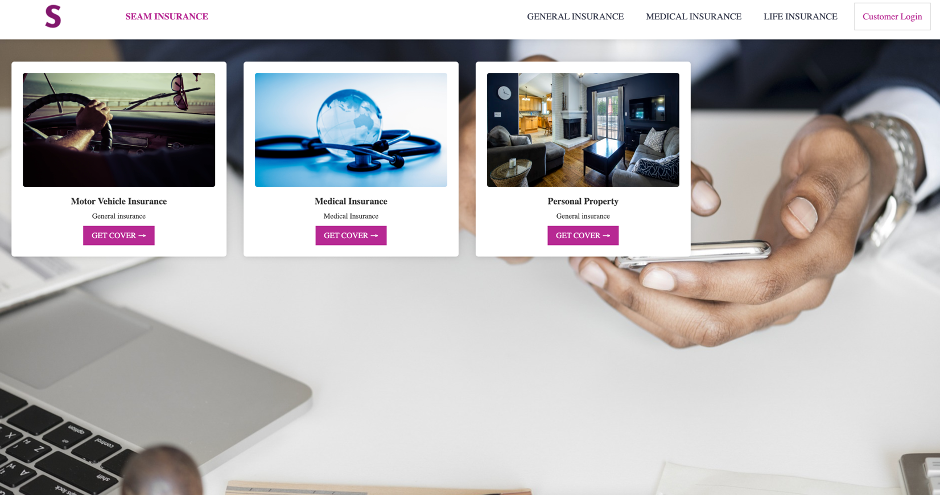

Seam Insure is an agile, end-to-end insurance SAAS technology for the distribution of Insurance. Seam Insure helps you save costs, streamline insurance processes and significantly improve customer experience levels. Its crafted around a robust insure-tech framework that takes care of clients in the space of Insurers, Micro-Insurers, Brokers, Agents, Sub-agents and affinity partners. Moreover, Seam Insure seamlessly integrated with world-class technologies like Microsoft Dynamics 365 and Oracle. Seam Insure provides your customers with a quick self-service portal that improves their underwriting experience. Among the features include:

- Insurance Master Data Management(Manage all insurance master data and relations including Contacts, Customers, Brokers, Agents, Insurance Companies, Insurance Objects (e.g. Vessels/Vehicles), Covers, Packages.)

- Multi-Product definition( The ability to define different types of products for different Insurance Companies).

- Automated Internal rating engine(Rating configurations for different products, automated premium computations).

- Reinsurance management(Direct link of facultative reinsurance in all insurance documents).

- Claims Management(claim reporting, claim to report with multiple claimants and corresponding covers directly linked to posted policies).

- Financial Management(Manage the general ledger, chart of accounts and daily financials, Receivables and payables).

- Policy administration( Renewals, Mid-term additions, cancellations).

- Broker Portal.

- Extensibility-API enabled.